During his recent town-hall meeting in Alliance, Governor Jim Pillen offered a possible solution to address the high property taxes throughout the state: increase state funding for education by eliminating exemptions for taxes on sales and services.

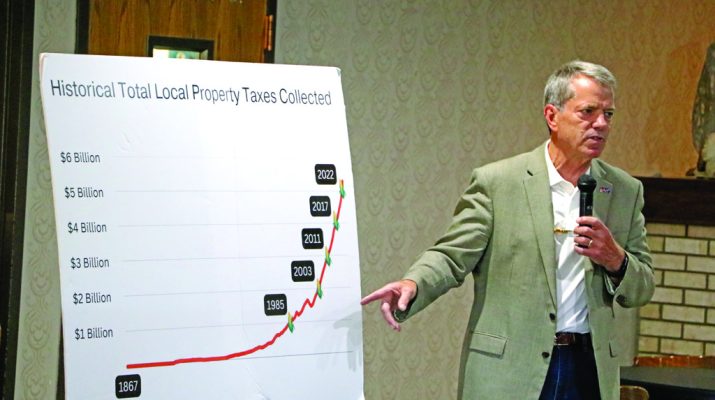

Pillen said that property taxes have continually increased, pointing to government spending statewide as the culprit.

“We’re a conservative state,” said Pillen. “The hardcore reality is our state, our university, every form of government, because we had the money because our economy was so good, we kept spending money. We kept spending money at five and six percent. No one ever said no to spending. Why? ‘Hell, we had the money. It’s okay, we had the money.’ Just think, if we had had fiscally conservative leadership, if we had run government like a business, we’d never be here.”

Pillen noted that broad-based sales tax, eliminating 120 sales tax exemptions, could help to eliminate the reliance upon property taxes. He said that since those exemptions began to be instituted in 1967, the property tax issue has continued to metastasize.

“We’ve just been duped,” said Pillen. “We’ve got to stop spending money. We’ve got to get back to a broad-based sales tax. We have to fix it, and we have to fix it now.”

Shifting to a broad-based sales tax, and increasing state funding for schools, Pillen said, could be the key to reducing the impact of property taxes. Pillen suggested hiking taxes on things like cigarettes and vape goods, and implementing an I-80 corridor tax.

He said that out of Nebraska’s 244 school districts, 180 school districts did not receive a dime from the state.

“The state of Nebraska has totally quit on our kids,” Pillen said. “Totally quit on our kids. Does anybody get ticked off when you think about the state quitting on our kids in 180 of 244 school districts?”

Pillen emphasized that educating children is crucial to the future of the state, which could result in property tax savings throughout Nebraska.

“If we the state do our job and quit quitting on kids, and fund our K-12 education, everyone’s property tax, whatever that number your property tax statement says you’re paying for K-12 education, goes to zero,” said Pillen. “You’ve got all the other entities yet, but they go to zero. The other key to the piece that’s so important, no disrespect to anybody here that serves on school boards, no disrespect on county boards, but our history’s crystal clear, our history’s crystal clear, every county’s taxing and spending is out of control. Everyone is. So I’m a believer that we have to have hard caps. Hard caps and not put the pressure on a small number of board members, but when you need more money, you take it to a vote of the people.”

Pillen said that reducing government spending must remain part of the conversation to address the rise in property taxes. The Alliance Times-Herald will publish more from Governor Pillen’s town-hall meeting in its next edition.